Program

-

(GMT)Securitization in the WAEMU: Lessons from 2023 & Future OutlookRoom SHILLING (Tent)

Access via sign-up on the event app or by invitation only.

The WAEMU & AFRICA SECURITIZATION FORUM is a unique platform aiming to promote securitization as an alternative and complementary financing instrument for African economies, while capturing technical and financial innovations.

After a year 2023 of several landmark transactions, this event will be a rare occasion to share experiences but also exchange ideas on the outlook and challenges of securitization in the WAEMU zone and in Africa. This forum will gather key players in the securitization ecosystem, namely Securitization Fund Managers (FCTC), regulators, capital markets firms, development finance Institutions (DFIs), as well as initiators, beneficiaries and operational intermediaries, banks and insurance companies.

-

(GMT)STRATEGIC ROUNDTABLE | Basel III in Africa: Crafting a path forwardRoom KWANZA #3 Roundtable

Access via sign-up on the event app or by invitation only

The implementation of international regulatory and prudential frameworks for African banks has been criticized as being both slow and insufficient. As of 2023, only South Africa (the only African member of the Basel Committee of Banking Supervisors) and Egypt have fully implemented Basel III, while very few countries intend to fully adopt it in the near future. While there is a consensus on the inevitability of implementing Basel III, some key industry actors have proposed the need for a specific pan-African framework with appropriate adaptations. A roundtable of commercial banks and government representatives discuss how to move forward on such a framework.

Discussion points

- From 2022 to 2023: The status and impact of Basel I, II, III on African banks and economies

- Risk weights in priority sectors, eligibility criteria for liquidity, calibration of concentration limits: What are the key adaptations needed?

- What kind of regulatory framework could accelerate and harmonize these adaptations?

Distinguished Guest

Distinguished GuestPaula LEYNES

Regional Industry Manager, FIG Africa Upstream and Advisory, Eastern and Southern Africa, IFC -

(GMT)CONVERSATION WITH | What next for Silicon Valley’s fintech investments in Africa?

Mareme Dieng oversees the Africa region for one of Silicon Valley’s most influential venture capital firms, 500 Global ($2.7bn AUM globally). The group has investments in 49 billion dollar companies, including Nigeria-based Chipper Cash, and has stakes in more than 100 African companies, including fintechs such as SweepSouth (South Africa), MaxAB (Egypt), Asaak (Uganda) and KaliSpot (Senegal). The firm has recently launched a Global Rise Report highlighting Nigeria and Egypt as part of the next 30 rise economies to grow in venture penetration and technological advancement. In an exclusive interview, the Senegalese national discusses the future focus of 500 Global’s Africa investments and the impact of a global economic downturn on fintech funding.

-

(GMT)STRATEGIC ROUNDTABLE | The next frontier: Will agtech revolutionize agrifinance to transform Africa’s food production?Room PULA #1 Roundtable

Access via sign-up on the event app or by invitation only

The world is witnessing a rapidly deteriorating food security situation and rising food prices. Africa is the most affected region despite its vast endowments in arable land. Africa could be two to three times more productive if it intensified its agricultural activities. With progress in agtech (connected community-based agents, geo-mapping, satellite-based monitoring, and digitalization of financial flows), agriculture equipment, agri-insurance, and contract farming, it is feasible to substantially de-risk the small holder farming that dominate Africa’s food production to levels where the agrifinance ecosystem can finance the sector, including smallholder farmers, to scale agricultural production. Is this the right time for financial institutions to expand agrifinance, and if so, what does it take to succeed?

Discussion points:

- Innovation: Can agtech play the same role for food security that mobile money has played for financial inclusion?

- Leveraging technology: How can technology reduce cost to serve and mitigate lending risks?

- Catalysing growth: How can innovative partnerships be established to scale agrifinance and reduce the food security gap?

- Key mitigants to agri-finance risk: What is the role of policy makers/governments?

Moderator

ModeratorRiadh NAOUAR

Manager, FIG Africa Upstream and Advisory, West, Central and North Africa, IFC

-

(GMT)PANEL Disrupters Club | Can deeper banking partnerships sustain the fintech golden age?

The collapse of Silicon Valley Bank, a lack of liquidity and increased regulation have rung alarm bells that the African fintech golden age is fading out with the value of African fintech funding declining 64% YOY in H1 2023. Deeper banking partnerships in payments, open banking, digital identification, blockchain and retail and SME lending could provide fintechs a new lease of life. But with commercial banks developing in-house capabilities and building their own super apps, to what extent will they need fintechs to vertically integrate? What will be the next wave of innovation fintechs can offer to expand banking partnerships?

Key points:

-

Customer experience and AI: What are the new horizons for fintech banking partnerships?

-

Between cooperation and competition: Could fintechs lose their lustre for banks?

-

Partnerships, equity investment, co-innovation: Which models will dominate and how can they be win-win partnerships?

Expert

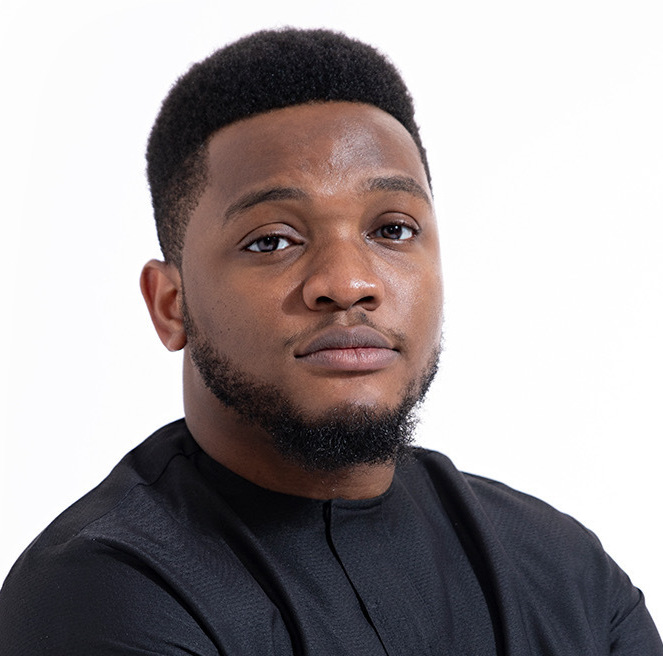

ExpertMayowa KUYORO

Partner and Head of Fintech and Payments for East Europe, Middle East, and Africa , McKinsey & Company

-

-

(GMT)PANEL | Open finance: Connecting the dots on big dataRoom SHILLING (Tent)

Nigeria’s bold step to adopt Africa’s first open banking regulation in March follows a trend in commercial banks embracing open APIs. Aimed at stamping out fraud, speeding up credit decisions and enabling new personalised products, open finance data partnerships are proliferating. But some banks are reluctant to open their APIs due to a lack of regulatory clarity outside Nigeria. Regulation conversely risks overstepping bounds as seen in one heavily industry-contested and since overturned proposal to centralise and control access to open banking APIs in Nigeria. Concerns also persist that multiple individual partnerships will leave banking and mobile money data, physical documents, and digital metadata, siloed and underexploited. What are the next steps to optimize data in the open finance era?

Key points

-

What processes and governance are needed to centralise open APIs and data?

-

Personalised financial services: What NPD will transpire and will it help industry financial performance?

-

Understanding data: How can advances in AI boost open finance?

-

-

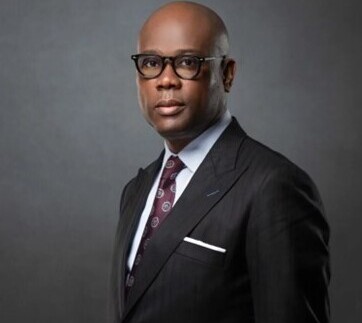

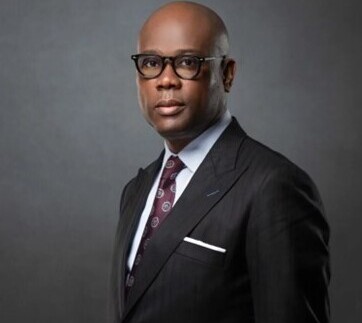

(GMT)CONVERSATION WITH | Dr. Herbert Wigwe, CEO, Access Holdings

-

(GMT)STRATEGIC ROUNDTABLE | Sophisticated financial products: A door to new financing for Africa?Room KWANZA #3 Roundtable

Access via sign-up on the event app or by invitation only

Africa is facing an unprecedented shortage of funding, higher borrowing costs and increased pressure on exchange rates. The private sector is also encountering huge difficulties in issuing securities on secondary markets. Estimates suggest Africa would need an additional $1.6 trillion by 2030 to achieve the Sustainable Development Goals (SDGs), but corporates are not yet leveraging sophisticated financial products, such as green bonds, securitization and investment funds, at scale as the products offered by players in the regional financial sector do not fully meet the needs of economic players or the characteristics of the financing requested. A roundtable of capital market players and DFIs discuss how to better meet private sector needs.

Discussion points:

-

How to eliminate obstacles that limit the development of new structured or sophisticated financial products by local players

-

What legal and regulatory framework should be put in place in order to secure all local stakeholders?

-

How can we support the ecosystem and regional players to achieve a good understanding and to adopt these products?

Distinguished Guest

Distinguished GuestFrancis MALIGE

Managing Director, Head of Financial Institutions Group, European Bank for Reconstruction and Development (EBRD)

-

-

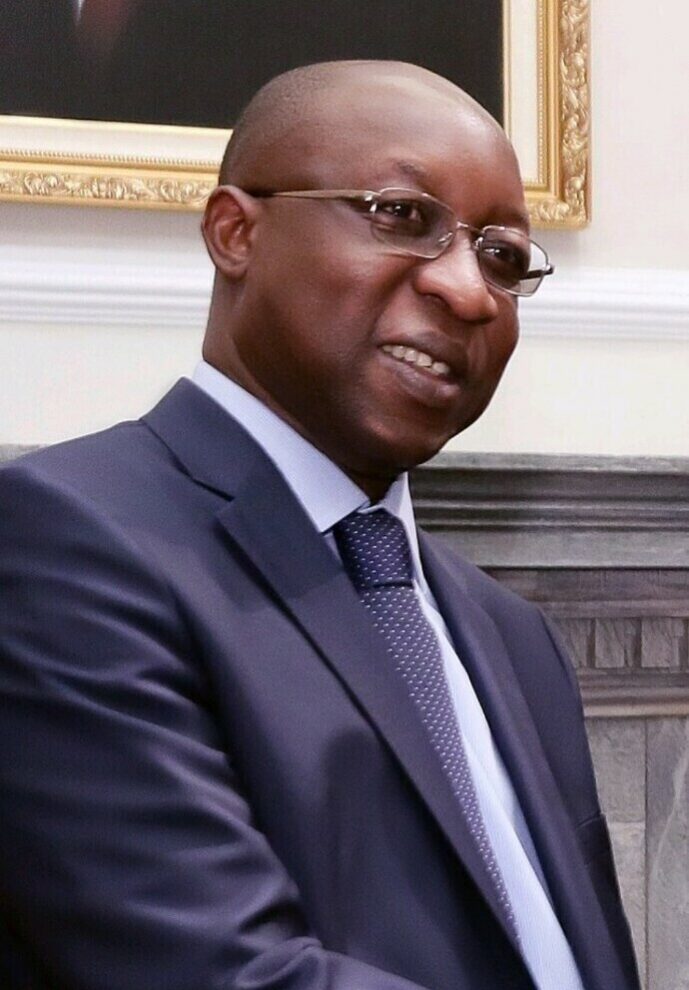

(GMT)PANEL NIGERIA | The pan-African future of Nigerian finance

Nigeria’s financial institutions are well positioned to build a greater pan-African presence with players such as Access Bank already expanding their footprints in francophone Africa. The Nigerian banking sector has recently faced inflation, profit-eroding cash reserve requirements and a managed foreign exchange system. But a return to economic orthodoxy at Nigeria’s central bank, unifying of exchange rates and a clearly defined monetary policy has driven substantial portfolio inflows. Can Nigeria now capitalise on the exit of international banking groups to position itself as an international financial hub for the continent?

Key points:

-

A growing presence: Where do the opportunities lie for Nigerian banks to strengthen regionally and internationally?

-

Open Banking, AI, Fintech: How can Nigeria go further to share best practices across Africa?

-

Trade finance and export credit: What support can Nigeria’s financial sector offer the continent’s banks?

-

-

(GMT)STRATEGIC ROUNDTABLE | Women In Finance: Unlocking untapped ventures - Overcoming gender disparities in start-up investmentsRoom DIRHAM #2 Roundtable

Access via sign-up on the event app or by invitation only

Women-led startups receive less than 3% of venture capital investments while women-founded firms, especially those backed by female venture capitalists, face significant challenges in securing additional funding. Moreover, there’s a notable gender gap in capital allocation, with less than 20 female-led funds in all of Africa. Female-led fintechs such as Klasha, and Ejara have broken the mold and brought innovations such as digital cross border payments to the market, but women entrepreneurs continue to face entrenched biases and structural inequalities. A roundtable of fintechs, DFIs, and other investors discuss how to improve access to finance and unlock the vast potential of women-led ventures.

Discussion points

-

Gender lens investing: How to integrate more deliberate gender analysis into investment decision-making

-

What hurdles have women faced in attracting investment and how might these be overcome?

-

Pitch competitions, access to angel investors & fintech hubs and incubators: How to increase the visibility of female-led businesses

Chair

ChairMazamesso ASSIH

Minister for Financial Inclusion and Organisation of the Informal Sector, Republic of Togo

Distinguished Guest

Distinguished GuestYenita BAMBA

Regional Head of Corporate and Financial Markets , Central and Eastern Africa, Société Générale

-

-

(GMT)PANEL | Keeping insurance profitable: Boosting capacity to absorb mounting risksRoom SHILLING (Tent)

Despite double-digit H1 2023 revenue growth for insurers in Côte d’Ivoire and Egypt, catastrophic climatic events are denting profitability in Africa’s non-life insurance sector and upping reinsurance costs. These unprecedented weather extremes since the start of 2022, come amid grid failures, heightened insurtech competition, incoming risk-based capital regimes and pressure to comply with new accounting standard (IFRS 17). As weather upheavals to date have not yet translated into increased insurance uptake, will the sector be forced to redefine coverage policies and up premiums or could some climatic risks be transferred to capital markets?

Key points

-

Floods and droughts: Reviewing exclusion policies and premiums without creating additional protection gaps

-

Risk-based capital: How should regulation reframe capital requirements amid escalating risks?

-

Insurance-linked Securities (ILS) and Catastrophe bonds: What scope exists to transfer risks to local and international capital markets?

Speaker

SpeakerKen AGHOGHOVBIA

Deputy Managing Director / Chief Operating Officer, African Reinsurance Corporation -

-

(GMT)Side Event PAPSS on "Facilitating cross-border payments across Africa with PAPSS"Room NAIRA

Access via sign-up on the event app or by invitation only

The Pan-African Payment & Settlement System-PAPSS organizes a private discussion on facilitating cross-border payments across Africa. PAPSS enables the efficient flow of money securely across African borders, minimising risk and contributing to financial integration across the regions.

In this exclusive gathering, PAPSS will also unveil the Africa Trade Gateway, a growing Internet Plateform dedicated to promoting International Trade in the African Continent.

-

(GMT)STRATEGIC ROUNDTABLE | Rethinking PPPs to plug the infrastructure gapRoom PULA #1 Roundtable

Access via sign-up on the event app or by invitation only

With African countries facing a $100bn per year infrastructure finance deficit, insufficient domestic resources, constraints on official development assistance and debt problems, the private sector is increasingly being urged to fill the gap, especially within public-private partnerships (PPP). However, some PPPs have proven ineffective and have posed risks for both governments and the private sector. A roundtable of financiers, private sector and government representatives discuss how to close the infrastructure gap more effectively with a properly adapted PPP model.

Discussion points:

-

What sectors and policy frameworks are conducive to effective implementation of PPPs?

-

How to leverage PPPs without weakening public finances or threatening fiscal and macroeconomic stability?

-

What role can donors and other development partners play in the use of this type of financing?

-

-

(GMT)STRATEGIC ROUNDTABLE | From credit to savings: Developing a digital micro-savings cultureRoom DIRHAM #2 Roundtable

Access via sign-up on the event app or by invitation only

Digital micro-savings emerged as the most exciting area of future innovation for central bank governors at AFIS 2022. In the last five years, many individuals and MSMEs in Sub-Saharan Africa have turned to regular mobile money accounts to save while fewer are saving with traditional financial institutions. While players like KCB (Goal Savings account) have joined M-Pesa (M-Shwari and M-Koba) in the space, savings remain peripheral to credit for many banks. High setup costs may meanwhile be hard to recover given public banking distrust and preferences for mobile money and village saving groups. A roundtable of banks, government representatives, fintechs and DFIs assess how to foster a culture of digital micro-savings that can benefit local economies.

Discussion points

- Financial literacy, trust building and embedded products: What can industry do collectively to further educate consumers on savings?

- Catalysing local growth: How could formal digital group savings invigorate local economies?

- Incentives, rewards and interest rates: Which offers can garner appeal while staying commercially viable?

Distinguished Guest

Distinguished GuestValens KIMENYI

Director of Financial Sector Development and Inclusion Department, National Bank of Rwanda

Distinguished Guest

Distinguished GuestGildas N'ZOUBA

Managing Director of SUNU Assurances VIE Côte d'Ivoire. , Sunu Group

Distinguished Guest

Distinguished GuestJean YENGA

Fintech Business Development Manager, Western & Central Africa, Visa CEMEA, Visa

-

(GMT)PANEL | A loan in 10 seconds: Innovation and AI to unlock MSME finance

Commercial banks, microfinance institutions and mobile money players hope to revolutionize finance for Micro, Small and Medium Enterprises (MSME) with innovations such as alternative data analysed by AI and machine learning to extend credit in seconds. While offering faster, transparent, easier and better tailored banking solutions for MSME clients, these methods rely on sometimes tricky data partnerships, internal technical expertise, and can bring privacy and built-in AI bias concerns. What will it take to be an innovative MSME finance leader?

Key points

- NPLs, banking profitability and MSME access: Where’s the proof that AI and alternative data help?

- Strengthening datasets: Keys to solid data partnerships and filling data gaps

- How adept is existing regulation in meeting the privacy and bias implications?

-

(GMT)PANEL | Bad banks and NPL securitization: A lifeline for troubled assets in a turbulent economy?Room SHILLING (Tent)

Commercial bank Non-Performing Loans (NPLs) rose 5.5% YOY in Morocco in 2022 while NPL ratios remain high for banks in countries such as Angola (21%) and Kenya (11.1%) as inflationary impacts weigh on customers. NPL securitization – selling bad loans to professional investors – have proven highly effective for Italian and Spanish banks to reduce NPL stocks on their balance sheets. Despite some attempts in Nigeria, for example with AMCON, these vehicles and structures remain limited in Africa due partly to restrictive regulatory frameworks and a lack of investor appetite. But with Morocco set to be the first African nation to create a secondary market for NPLs, can banks take greater advantage of these derisking opportunities?

Key points

-

Securitization and bad banks: Finding the right structure and guarantees to attract investors

-

Secondary market for NPL and securitization conditions: How can regulators provide banks NPL relief?

-

Determining a fair value to offload NPLs

-

-

(GMT)CONVERSATION WITH | The future of crypto in Africa

American tech entrepreneur Chris Maurice leads Africa’s largest centralised cryptocurrency exchange, Yellow Card (1.4m users and $1.75bn in transactions since its 2019 launch). With backing from Jack Dorsey’s Block, Yellow Card is challenging traditional finance by promising Africans faster and cheaper international remittances and a hub to trade bitcoin and other cryptocurrencies. In an interview with Mamadou Toure, Founder and CEO, Ubuntu Group, Mr Maurice delves into cryptocurrency’s prospects across Africa in the wake of FTX’s downfall and impending virtual asset regulations.

-

(GMT)CONVERSATION WITH | The next phase for telcos in finance

Serigne Dioum, Group CEO of MTN Fintech (MoMo, insurance, airtime lending and e-commerce), leads a division that has been a catalyst for financial inclusion across Africa. With 60.5 million Momo users and $135.2bn in transactions value (+61.6%) in H1 2023, the Johannesburg-based telco’s fintech business is now eyeing new partnership opportunities to build on a landmark collaboration with Mastercard that has significantly accelerated MTN’s remittance activities. In an exclusive interview, Mr. Dioum discusses the future direction for MTN and other leading telcos in financial services, spanning from open APIs to insurtech and payments.

-

(GMT)Central Bank Governors PANEL | The politics of money: How can Africa emerge stronger?

African central banks find themselves at the centre of a high-stakes political debate on the continent’s monetary future. On one front, reserve and trade currencies are under the spotlight in an expanded BRICS bloc, bolstered by Egypt and Ethiopia, that favours de-dollarisation through increased local currency trade or a BRICS trading currency. On the other front, African nations are being urged to form closer monetary union in the wake of the AfCFTA. An East African Monetary Union, initially set for 2024, is now in the works for 2031 while Kenyan President William Ruto went further in June, proposing a single African currency, an idea described as “impossible” by South Africa’s central bank chief. In a politicised landscape, what form of monetary union and common reserve or trade currency strategy will strengthen Africa’s economic position?

Key points:

-

National, single African, regional or BRICS: Which domestic and trade currency strategies will bring prosperity?

-

Laying the groundwork for monetary union: Resolving domestic currency convertibility

-

Could high and divergent interest rates stifle moves to unified currencies?

-