Program

SUSTAINABLE, BORDERLESS AND DIGITAL – TRANSFORMING FINANCE IN THE AGE OF DISRUPTION

Africa has been at the global forefront of modernising financial services. By expanding world-leading

mobile money operations, taking steps towards offering green finance and more recently introducing Central

Bank Digital Currencies, financial institutions have been building foundations for improved financing of African

economies.

Yet the sector’s sweeping sustainable, borderless and digital transformation is about to take place under extreme volatility that most industry executives have never experienced. In this high-risk macroeconomic environment, the financial industry’s profitability is likely to come under pressure, from deteriorating asset quality, liquidity risks and scarce available capital as well as emerging climate and cyber risks.

Read more about the programme presentation

-

(GMT)PANEL | Africa’s infrastructure gap: Structuring blended finance in a global slowdownRoom CAURI

DFIs are increasingly turning to blended finance, particularly for 10+ year ventures projects that help to close Africa’s widening $100bn annual infrastructure funding gap. With local commercial banks often lacking capacity for long-tenures and 90% of projects on the continent failing due to inadequate risk allocation and feasibility studies, more blended finance transactions are underway in Sub-Saharan Africa (216 in total) than any other region. But the blended finance model, allowing institutional investors and the private sector to back projects in early-stage development, will be tested in a global economic slowdown. How should this model be strengthened as affordable financing comes under threat?

Key points:

- How can collaborators best allocate risks and enhance profits in a challenged economy?

- How can government reforms catalyse more local currency lending and derisk investments?

- Pension funds and philanthropists: Diversifying the pool of blended finance partners

Speaker

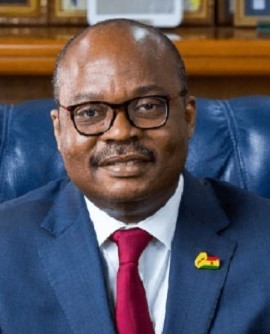

SpeakerMohamed El Fadel KANE

Managing Director Head Capital Markets & Structured Finance Group Sub-Saharan Africa, Société Générale

Expert

ExpertDan CROFT

Regional Upstream Manager, Infrastructure, Africa, , International Finance Corporation (IFC)

-

(GMT)STRATEGIC ROUNDTABLE | Fintech: Building a pan-African regulatory framework to inspire innovationRoom PULA

Access via sign-up on the event app or by invitation only

Between 2020 and 2021, Africa’s tech startups tripled to 5000+ companies. Just under half of these are fintechs with estimated revenues of $4-$6 billion in 2020. African fintech disruption has evolved to a ‘fintech eruption’ as local and international investors seek opportunities on the continent. Amid this positive trend, regulators from Sub-Saharan Africa are advancing with fintech regulations. SSA has proportionally less regulatory frameworks for P2P lending, Equity Crowdfunding and eKYC in comparison to the Middle East and Asia-Pacific, even though such frameworks can foster an enabling fintech environment. Where are African economies and its financial sector regulators heading? “Test and Learn” or overregulation stifling innovation?

Discussion points:

- The role of regulators: From Digital Lending to Crowdfunding, what are the new risks and opportunities that regulators are going to face?

- What are the skills and technical support that regulators need to support the fintech ‘eruption’?

- Fintech: What are their expectations for a balanced regulatory approach?

- Developing a fintech Sandbox for your country: Is it desirable and are regulators’ resources adequate?

Moderator

ModeratorRiadh NAOUAR

Manager - FIG Advisory Services, Africa, International Finance Corporation (IFC)

Distinguished Guest

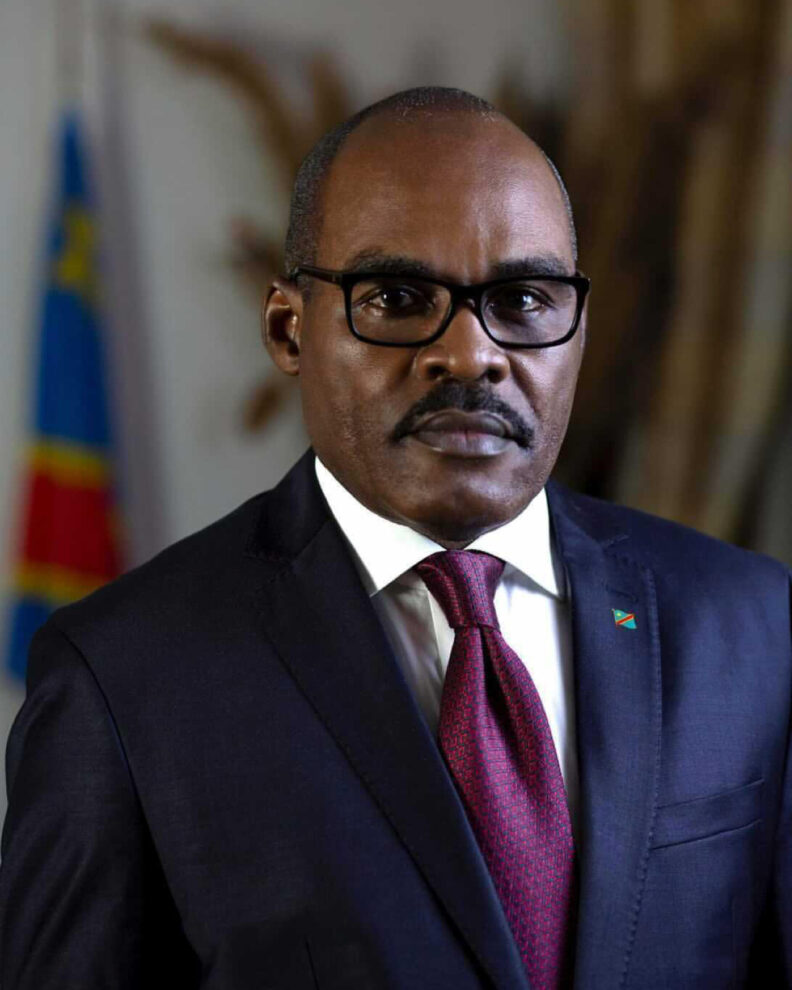

Distinguished GuestAlain KANINDA

Managing Director, Insurance Regulatory and Supervisory Authority (ARCA)

-

(GMT)STRATEGIC ROUNDTABLE | Women Working for Change: Improving gender parity in the BoardroomRoom DIRHAM

Access via sign-up on the event app or by invitation only

Most African banks had on average one woman on their boards (10% representation) at any one time between 2006 and 2018. This is despite scientific research suggesting women on boards of African banks provide prudent decisions on financial information disclosure that reduce the risks of banking crises. How can financial institutions champion greater representation? What regulatory reforms may be necessary? A closed roundtable of bankers, insurers and large fintechs, assesses how to reach gender parity in the Boardroom and on executive committees.

Discussion points:

- To what extent are government reforms needed and what form should they take?

- How can organisations themselves push for more than one token woman on the Board?

- How could financial institutions improve ESG reporting on women in decision making roles?

- What achievable targets or quotas should be implemented?

Distinguished Guest

Distinguished GuestMareme MBAYE NDIAYE

Regional director Central and Eastern Africa, Société Générale Distinguished Guest

Distinguished GuestMyriam D'almeida DOSSOU

Minister of Grassroots Development, Youth and Youth Employment, Republic of Togo -

(GMT)STRATEGIC ROUNDTABLE | Trade finance and correspondent banking: Tackling headwinds from global compliance requirementsRoom NAIRA

Africa, as a continent, has tremendous potential to grow its trade, both international and intra-regional, but logistics, policies and financing gaps hinder such potential. Trade finance is essential to enable the flow of goods and services. Since the pandemic, the trade finance gap, which was already significant, has increased to an estimated US$90 billion. Meanwhile, international standards, particularly Anti-Money Laundering (AML) and Know Your Customer (KYC) rules, are intensifying compliance requirements on international banks and their African correspondent banks. A closed roundtable of banks and regulators proposes concrete steps to reduce the trade finance deficit.

Discussion points

- What would African banks need to expand access to trade finance?

- What kind of products should African banks expand? Could Supply Chain Finance be one of solutions?

Chair

ChairNathalie LOUAT

Director, Trade & Supply Chain Finance , International Finance Corporation (IFC) Chair

ChairDenis MEDVEDEV

Director Economic Policy Research Department, International Finance Corporation (IFC)

-

(GMT)Conversation With | Paul RussoRoom CAURI

Paul Russo now presides over East Africa’s largest bank (28m customers), an 8,500-strong staff, and $10.2bn total assets after being named CEO in May this year. With KCB Group since 2014, he takes the top job during a period of profound change: group targets to align lending portfolios to reach net zero carbon emissions by 2050, global instability sparking an 8.6% rise in NPLs and inflation in KCB’s home market, as well as a new government in Kenya. In an exclusive interview, Paul Russo shares his vision on the future of banking and the continental expansion of Kenyan banks.

-

(GMT)PANEL | CBDCs and Crypto: A brave new world for African finance?Room CAURI

Nigeria’s e-naira could kickstart a Central Bank Digital Currency (CBDC) evolution. A dozen African nations are conducting feasibility studies, while regional CBDCs in East and Central Africa are also touted. Cryptocurrency, the decentralised cousin of CBDCs, is meanwhile hugely popular with consumers, but its place in Africa’s financial ecosystem remains uncertain. Aimed at enhancing financial access, combating fraud, and enabling faster and cheaper remittances, these two digital innovations conversely add complexity for commercial banks to have compatible products, expertise and cybercrime capabilities. There are further fears that banks may be overlooked as financial intermediaries or lose out on remittance fees. Are CBDCs and cryptocurrencies a threat or opportunity for Africa’s financial industry?

Key points:

-

How will dozens of CBDCs and cryptocurrencies impact regional integration and financial market complexity?

-

Disintermediation: How to ensure CBDCs do not bypass commercial banks, replace mobile money and lead to tighter crypto regulations

-

From risk management to leveraging CBDC transaction data: What internal measures should insurers and banks take to prepare?

-

-

(GMT)STRATEGIC ROUNDTABLE | Private equity in Africa : opportunities in global shocksRoom KWANZA

Access via sign-up on the event app or by invitation only

Private capital fundraising in Africa registered a record year in 2021 on the back of an exceptionally vibrant tech start-up scene still outperforming in the first half of this year with a total of 3,5 billions $ of VC raised, a 133% increase from H1 2021. Financial inclusion continues to drive higher returns for fintechs, specially in “Big Four” countries such as Kenya and Egypt – even though fund managers are subtly readjusting investment requirements in the face of a looming global recession. The energy crisis brought about by the war in Ukraine is also reshuffling global supply chains : will African SMEs manage to capitalise on their geographical advantage as compared to Asian operators ? On a longer term perspective, will impact savvy investors continue to address the continent’s huge electricity, logistics, health and education needs despite rising interest rates?

Discussion Points:

- Fund managers’ new requirements to invest in Africa’s fintechs and traditional financial institutions

- PE turning to African SMEs and their role in import substitution and shortened global value chains

- DFIs’ continued support to African development goals to mitigate interest rate increase?

-

(GMT)STRATEGIC ROUNDTABLE | Digital banking: Changing mindset for legacy banksRoom NAIRA

Access via sign-up on the event app or by invitation only

Bank apps are amongst the most frequently used apps by customers throughout Africa. On average, digitally active customers interact with such apps every two days, compared to every 6 days with ATMs and every 26 days with the branch for simply active customers. However, digitization is expensive and the returns have been low for many banks. The average digital adoption rate, at 30% of active customers, are half of other emerging markets and average digital sales are less than 5%. Few banks have built digital marketing teams. During this roundtable, bank, mobile money executives and regulators will discuss what is required to truly get the value out of digital.

Discussion points:

-

What is required to monetize the digital investments?

-

Do banks really need to become technology companies?

-

What is the role of the branch and call centers in an increasingly digital distribution model?

-

-

(GMT)STRATEGIC ROUNDTABLE | Affordable homes: Making housing financing more accessibleRoom DIRHAM

Access via sign-up on the event app or by invitation only

Africa has the highest rate of urbanization, and it is estimated to have a housing deficit of at least 56 million units. African cities become the new home to over 40,000 people every day, many of whom find themselves without a roof over their heads. These statistics suggest that better housing finance systems are needed to meet the growing demand for housing that African countries are facing. Financial innovation – such as housing PPPs, rent-to-own models, green financing, and housing microfinance could unlock access to housing and housing finance. But how can such models be leveraged at scale? How can stakeholders steer the sector in a sustainable direction in which it could attract and increase financing to construct affordable housing at scale including off-take financing?

Discussion points:

- Key trends and challenges preventing growth of housing the sector in Africa

- Addressing the supply side – the supply of housing has not kept pace with the demand. What is needed to catalyze the space and flow of the much-needed financing for developers?

- Addressing the demand side-what are the alternative products to support end-user financing?

- Scaling innovation – the possibilities in rent-to-own models, housing microfinance and capital market instruments such as securitization, REITs, etc…

-

(GMT)STRATEGIC ROUNDTABLE | Climate finance: Removing barriers to participationRoom PULA

Access via sign-up on the event app or by invitation only

In 2020, Africa attracted $29.5bn in climate finance, just 12% of its annual needs for the current decade. Due to the depth of financial markets, the governance and technical risks of projects, as well as the creditworthiness of end customers, the private sector plays a marginal role and made up just 14% of total flows in 2019/2020. This roundtable brings together bankers, insurers, DFIs and government representatives to discuss innovations to increase private climate finance on the continent.

Discussion points:

-

Project barriers: How to improve technical assistance and upstream project preparation?

-

Financial barriers: Which instruments can secure affordable short- and long-term funding throughout the life cycle of a project?

-

Which changes to regulatory frameworks could foster additional climate finance?

-

-

(GMT)Conversation With | Mike Ogbalu IIIRoom CAURI

Former CEO of Nigerian card payment company Verve, Mike Ogbalu III, is overhauling digital payment infrastructure on the continent as CEO of the ambitious Pan African Payment Settlement System (PAPSS). Established by Afreximbank and the AfCFTA Secretariat in January 2022, PAPSS seeks to facilitate simple and instant cross-border payments in local currencies, eliminating foreign intermediaries. Already connecting Africa’s largest commercial banks, PAPSS is due to expand to fintechs and mobile money providers. How far can PAPSS go to improve intra-Africa trade (15% of total trade in 2019) amid divergent compliance regimes and challenging technical interoperability? And will PAPSS spell the end for existing payment systems?

-

(GMT)PANEL | AfCFTA: Could the African financial sector be an engine for growth?Room CAURI

While the AfCFTA has been operating since January 2021 and has been ratified in 43 countries, the funds allocated to African trade have been steadily declining, resulting in a deficit of around $100 billion per year. Faced with limited resources, difficulties in making Intra-African payments and limited currency convertibility, what reforms are necessary to make the financial industry a key vehicle for AfCFTA’s growth? How can the financial industry take on a leading role?

Key points:

-

Labour agreements, standardised QR codes, and pan-African dispute handling: AFIS proposals to speed up integration

-

Consolidation and growth: What impact can the AfCFTA have on the African financial industry and in what timeframe?

-

Should common financial regulations be established?

-

-

(GMT)PANEL | Disrupters Club - Is winter coming for African fintechs?Room CAURI

Africa’s financial-technology is one of the most promising sectors with revenue expected to soar to $30bn by 2025 – eight times higher than in 2020 – as a growing and under-banked population gets more access to internet. Yet many hurdles still have to be crossed. The consequences of the pandemic combined with those of the Ukrainian war are slowing down venture fundings. Complex and variable regulations, including license approval processes, as well as allegations of poor internal governance, have made it difficult for fintechs to ensure compliance across markets and business continuity. Could this perfect storm pop the African fintech bubble? How can startups remain vigilant in a uncertain economic environment, and focus on creating a sustainable, long-term fintech ecosystem?

Key Points:

- Multi-year contracts, nondilutive government incentives, loans, venture debt: How to navigate the drop of capital funding?

- Bad governance: What regulatory trends and domestic regulations should we expect?

- How do we promote a more effective understanding and implementation of financial inclusion products and strategies?

-

(GMT)STRATEGIC ROUNDTABLE | Cyber-crimes: Designing a strong governance strategy to mitigate risksRoom DIRHAM

Access via sign-up on the event app or by invitation only

Financial institutions are among the leading targets of cyber-attacks. Although innovative technologies are helping the industry to expand, these advancements also expose them to cyber threats. This makes technology risk management, data integrity and security, as well as preserving confidentiality, integral for financial institutions to operate sustainably and keep the trust of their stakeholders. How can the sector create and implement cyber governing mechanisms to achieve these goals? What are the benefits for financial institutions to strengthen their cyber governance? This roundtable will present tools and good practices to identify, prevent, manage and anticipate cyber threats while strengthening financial governance.

Discussion points:

-

Cyber and information security governance as a strategic priority for financial institutions

-

Common threats faced by financial institutions and their impacts

-

Tools and best practices to implement a sustainable cyber and information governance strategy

-

Benefits to increase cyber security awareness among employees and stakeholder

Moderator

ModeratorFranck KIÉ

Managing Partner & General Commissioner, Ciberobs Consulting - Cyber Africa Forum (CAF)

Distinguished Guest

Distinguished GuestMamadou TRAORE

Deputy Secretary-General, Conférence Interafricaine des Marchés d'Assurances (CIMA)

-

-

(GMT)STRATEGIC ROUNDTABLE | AfCFTA: How to advance towards harmonised monetary policiesRoom PULA

Access via sign-up on the event app or by invitation only

Effective from 1 January 2021 after its ratification by 54 of the continent’s 55 countries, the African Continental Free Trade Area (AfCFTA) represents the largest free trade area in the world with a market of 1.3 billion people and a GDP of $3.4 trillion. Achieving the political and economic objectives of the AfCFTA and accelerating African integration requires progressive elimination of tariff and non-tariff barriers and harmonisation of policies and legislation across the continent. A closed roundtable of central bankers, financial institutions and government ministers discusses how far monetary policies could converge across Africa.

Discussion points:

-

Monetary cooperation and harmonisation on a continental level: Current state and challenges

-

Can Africa finance its own growth? What structural reforms should be implemented?

-

The role and influence of central banks in Africa’s financial and monetary integration

-

Monetary policy as a driver of African integration: Requirements and approach

-

-

(GMT)STRATEGIC ROUNDTABLE | Generating higher returns in sustainable finance for corporate clientsRoom KWANZA

Access via sign-up on the event app or by invitation only

As corporate clients face pressure to evaluate carbon footprints and mitigate and adapt to climate change, opportunities are growing to offer new finance solutions (sustainability linked loans/bonds, on-site renewable energy financing, sustainable supply chain financing). Globally, sustainable-linked lending rose from $5bn in 2017 to $120bn in 2020 but this remains a niche activity in Africa. Meanwhile, African financial institutions might be impacted by regulatory changes in the EU and the USA pushing financial institutions to integrate climate risks. This closed roundtable asks how Africa’s financial institutions can enrich their sustainable finance offers.

Discussion points:

-

What are the most promising business opportunities related to ESG trends and what are the related risks?

-

How could stricter regulatory frameworks worldwide affect the African financial institutions?

-

Strengthening sustainability expertise to mitigate ESG-related risks and ensure profitability

Chair

ChairPayadowa BOUKPESSI

Minister of State, Minister of Territorial Administration, Decentralisation and Territorial Development, Republic of Togo -

-

(GMT)PANEL | Long-term resources, IPOs & integration: Stimulating Africa's underexploited stock exchangesRoom CAURI

In 2020, Africa only saw five IPOs compared to 822 in Asia and 316 for NASDAQ. On the continent, the majority of stock exchanges remain modest in size, with only three having more than 100 companies listed – compared to 112 African companies present on the London Stock Exchange. However, their role is key in financing economies, promoting African champions and helping AFCTA succeed. Lack of liquidity and depth, unavailability of information, a limited number of players, a weak stock market culture and insufficient fluidity of capital circulation, the reasons for the African market’s underperformance are numerous. What concrete solutions can change the situation?

Key Points:

- The role of private equity, interconnecting markets and developing long-term institutional savings: How to multiply and ensure the success of IPOs?

- How can stock exchanges become a major lever for long term resources in sustainable finance, infrastructure and public sector financing?

- How could digital innovations increase the depth and liquidity of African markets?

-

(GMT)CLOSING PANEL | A new economic order: How could systemic global reform benefit Africa?Room CAURI

While inflationary pressures persist (+7.6% in August in South Africa, +34% in Ghana) and African currencies continue to depreciate against the dollar, African central banks are watching more powerful countries extend the limits of usual macroeconomic orthodoxy. The US Treasury Secretary and others have called for Bretton Woods reform – fundamental changes at the World Bank and the International Monetary Fund designed to increase capital access and avoid debt cycles for developing countries. Meanwhile, digitalisation and the rise of fintech requires Africa’s regulators to push through their own reforms to support financial inclusion. What global and domestic reforms can work to Africa’s advantage?

Key points:

- Global economic governance changes to support African growth

- Currencies: The dangers of a strong dollar

- Fintech and cryptocurrencies: Are central banks being too cautious?