Initial findings from the upcoming African Financial Industry Barometer reveal where hundreds of Africa’s banking, fintech, and capital markets executives see AI having the biggest potential impact – and the regulatory gaps they want addressed most urgently.

The Barometer co-authors, Deloitte and AFIS, unveiled preliminary findings of the 5th edition of the Barometer at AFIS 2025 in Casablanca on 3 November.

The annual survey, conducted between May and September 2025, captures the views of senior executives across banking, insurance, fintech, and capital markets.

The full report – due to be published in January 2026 – sheds light on how the sector is navigating AI, advancing sustainable finance, and whether financial inclusion is truly seen as a business priority.

Initial results point to six key trends:

1 – Financial leaders see brighter outlook for their own firms

African financial executives rated the economic prospects of their own organisations over the next three years at 8 out of 10, a rise of 0.72 points from 2024.

Seventy-four per cent reported a positive outlook and only 4% a negative one, supported by stronger turnover and easing inflation.

Pan-African institutions were the most confident, giving their three-year prospects a score of 8.11 out of 10, led by commercial banks. International players were less assured at 7.45, down 0.66%, while capital-market respondents were markedly more cautious at 6.50.

Speaking at AFIS 2025, Frederic Maury, Deputy CEO – Events at Jeune Afrique Media Group, the company behind AFIS, said that despite the optimism “there are two main hurdles at play here”.

“First, the volatility of our capital markets, which is still heavily influenced by foreign investment flows. And second, our regulatory framework, which needs further refinement despite the monetary policies already in place to drive convergence,” he said.

2 – Concerns on talent shortages easing

Pressure on talent is showing signs of relief. Only 30% of respondents flagged talent shortages and recruitment challenges as their main concerns at present, a decline compared to last year’s Barometer.

Ziad Baddou, Director of Deloitte Consulting Morocco said: “Since the start of this Barometer — now in its 5th edition with Deloitte — talent pressure has always ranked very high.

“This year it remains high, but it has decreased. We feel that the financial industry has invested heavily in talent in recent years, and these investments are now paying off, reducing stress around recruitment.”

He added that Artificial Intelligence and to some extent the return of the diaspora has also lightened the burden on recruitment.

3 – Financial inclusion ‘not a priority’ for more than a third of respondents

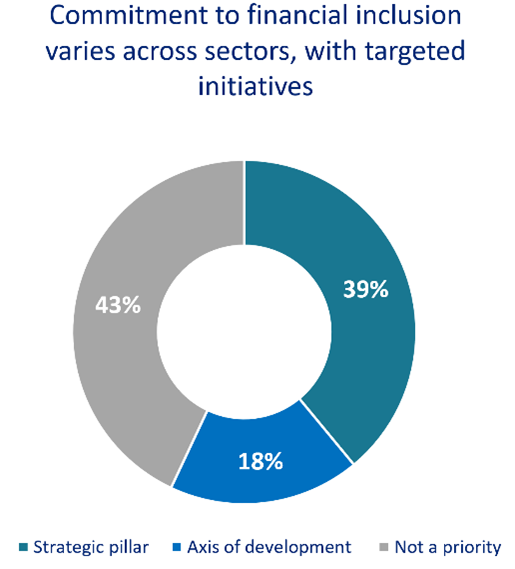

Scaling up access to financial products was not a priority for 43% of industry leaders surveyed. But results varied considerably depending on the sector.

Eighty-four per cent of fintechs consider financial inclusion strategic or an area for development. Though results among bankers and insurers were more mixed.

“Among banks, it is mainly international groups that see this as an ‘obligation’ rather than a priority,” said Frederic Maury.

“In general, the current ‘back to basics’ trend is pushing bankers to focus on operational efficiency rather than inclusion, which is seen as much as a growth area as a regulatory/CSR obligation,” he said.

For financial firms prioritising financial inclusion, improved digital infrastructure and interoperable financial systems are seen as the keys to expanding access.

4 – AI’s main role in African finance will be to sniff out fraud

AI adoption is surging across Africa’s financial sector, with executives saying its biggest impact over the next three years will be in fraud detection.

The survey found that commercial banks are mainly deploying AI to analyse operational, credit and market risks; Insurers are prioritising AI for customer acquisition, while fintechs use cases are focused on automating services and operations.

Deloitte’s Ziad Baddou said that despite the rise in AI, stumbling blocks prevent the technology from being deployed more broadly.

“One major barrier is the still-limited use of cloud technologies, which restricts the scope of what is possible.

“The second is data — classification, use, and collection must become more efficient to broaden the field of possible applications. The third is regulation, which must evolve in the coming years to support the expansion and growth of AI use cases in the financial sector.”

5 – Regulatory reform needed for data protection & cybersecurity standards

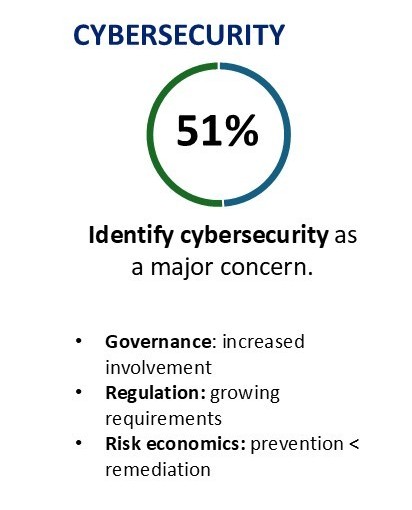

Executives flagged ‘data protection and cybersecurity standards’ as the most urgent regulatory reform to support Africa’s financial sector.

“Cybersecurity is now the subject of massive investment and an area where the industry is calling for more regulation and a clearer legal framework,” said Frederic Maury.

He added that the survey indicated longer-term structural challenges in need of regulatory attention.

“One is interoperability,” he said. “There are hundreds of millions of mobile money accounts across Africa, and interoperability remains a real challenge. Initiatives exist, but the industry is impatient to see progress accelerate, as this would be a genuine game changer for African finance.”

6. Gender parity advances, women-focused products lag

Forty-seven per cent of respondents said workforce gender parity policies are fully implemented, with a further 37% planning deployment.

“On gender parity, what we observe across the continent is that policies are making substantial progress, particularly on parity itself. However, we note that products designed exclusively for women are harder to implement as they are more complex to design and execute,,” said Ziad Baddou of Deloitte.

The full Barometer report will be available on the AFIS website from January 2026.