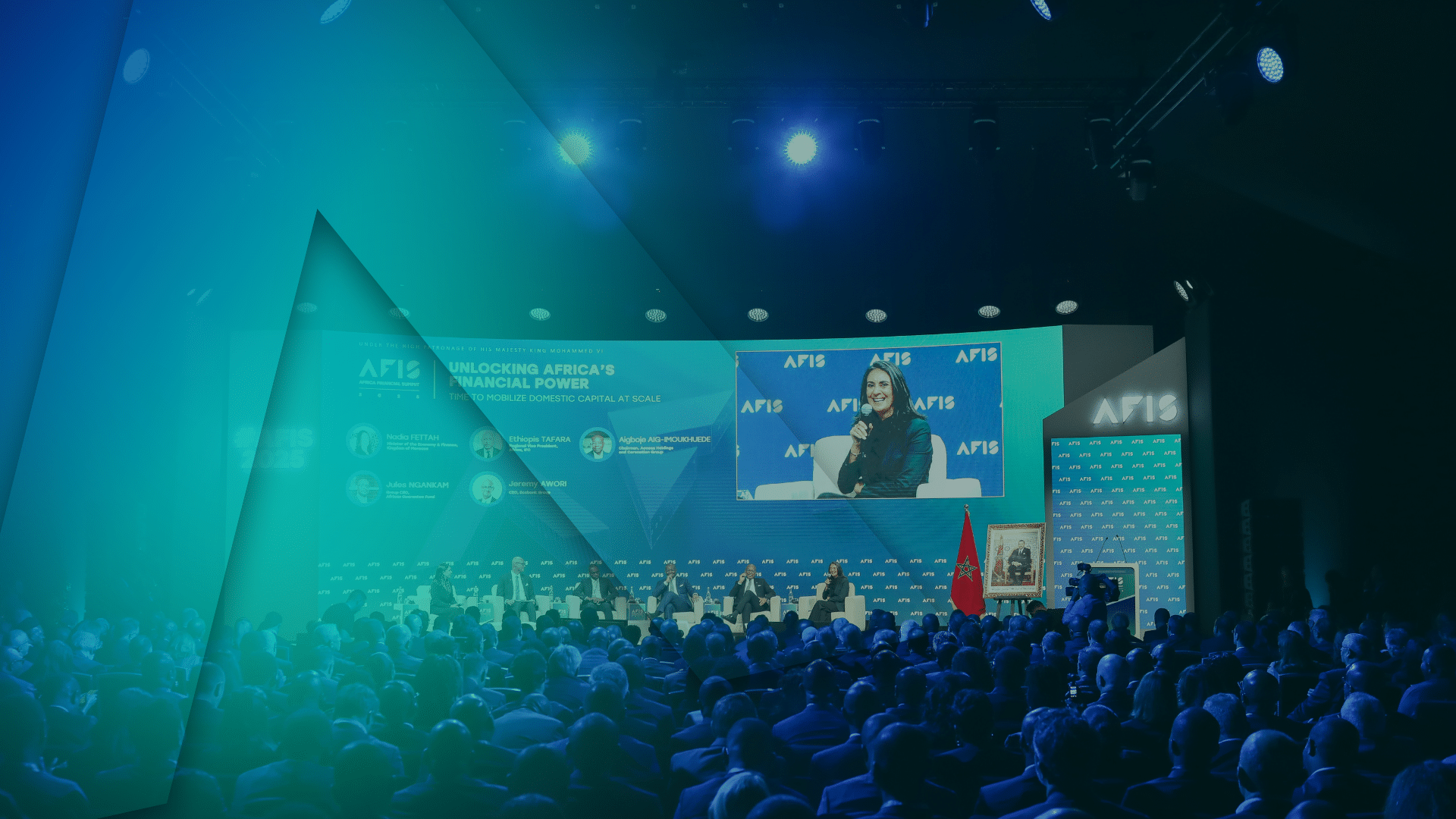

Casablanca, 3 November 2025 – The fifth edition of the Africa Financial Summit (AFIS) opens today in Casablanca under the theme: “Unlocking Africa’s Financial Power: Time to mobilise domestic capital at scale”.

Organized by Jeune Afrique Media Group, in partnership with the International Finance Corporation (IFC), a member of the World Bank Group, and the Kingdom of Morocco, AFIS 2025 brings together for two days more than 1,200 financial leaders, public decision-makers, and regulators from across the continent and around the world.

Since its inception in 2021, AFIS has established itself as the leading public-private dialogue platform dedicated to building a world-class African financial industry. This new edition marks a key step in the collective reflection on mobilizing the continent’s capital. In a global environment characterized by high interest rates, persistent geopolitical tensions, and greater selectivity of international capital, African stakeholders agree on one priority: to build financial ecosystems capable of mobilizing and channeling African savings toward the continent’s productive investments.

As many major transformation projects in energy, infrastructure, and digital sectors require massive investment, Africa must be able to rely more heavily on its own financing levers. The paradox of a resource-rich yet under-financed continent is at the heart of this year’s AFIS discussions. To address it, participants will explore suitable regulatory frameworks, innovative financial instruments, and public-private partnerships capable of turning African economies into regional investment powerhouses.

Amir Ben Yahmed, President of the Africa Financial Summit, said: “Africa is not short of capital: it lies in our banks, our markets, our insurance funds, and even in our phones. What it still lacks is ambitious regulation and solid bridges to channel this capital towards development. That is the very purpose of AFIS: bringing together Africa’s financial actors to jointly build an architecture capable of financing our own ambitions.”

Makhtar Diop, Managing Director of the International Finance Corporation (IFC), said: “Mobilizing all our resources – African savings, regional markets, global capital – is the key to sustainable growth. The theme of AFIS 2025 – Unlocking Africa’s financial power: time to mobilize domestic capital at scale – shows how necessary this transformation is. Success depends on us all.”

H.E. Mrs. Nadia Fettah, Minister of Economy and Finance, stated: “Financial sovereignty is not a slogan; it is an imperative, a collective duty, a handover between African generations. These words commit us (…) Africa does not seek to isolate itself from the world. It wishes neither to build walls nor cut itself off from exchanges, but to reclaim control over its economic destiny. It wants to choose its partnerships, influence the rules of the global game, and shape its priorities according to its own needs – no longer according to cycles or constraints dictated from elsewhere.”

Over two days, more than thirty conferences, workshops, and roundtables will give participants the opportunity to actively shape the transformation of Africa’s financial landscape. AFIS 2025 will bring together leaders of major banking and insurance institutions, fintechs, regional stock exchanges, and regulatory authorities to build the foundations of a resilient, integrated, and forward-looking African finance.

Among the personalities present in Casablanca are leaders of the largest development finance institutions, including Makhtar Diop (IFC), Serge Ekué (BOAD), Dr. George Agyekum Donkor (ECOWAS Bank for Investment and Development), Jules Ngankam (African Guarantee Fund), and Ethiopis Tafara (IFC). Representatives of the continent’s leading banks, insurance companies, capital markets, fintechs, and pension funds are also in attendance: Aigboje Aig-Imoukhuede (Access Holdings & Coronation Group), Mohamed El Kettani (Attijariwafa Bank), Jeremy Awori (Ecobank), Mohamed Bah (SUNU Group), Idrissa Nassa (Coris Bank International), Thierry Hebraud (MCB), Amine Bouabid (Bank of Africa), Luís Filipe Rodrigues Lélis (Banco Angolano de Investimentos), Abdeslam Alaoui Smaili (HPS), Mohamed Hassan Bensalah (Holmarcom), Solomon Quaynor (AfDB), Dr. Tilahun Esmael Kassahun (Ethiopian Securities Exchange), Abdou Diop (Forvis Mazars), Edoh Kossi Amenounvé (BRVM), Isabel Espírito Santo (Banco Millennium Atlântico), Ouafae Mriouah (Atlantic Re), Khalid Safir (CDG Maroc), Gilles Tchamba (l’Archer), Karim Ezzeddine (SkyKapital), Haytham El Maayergi (Afreximbank), Corneille Karekezi (Africa Re), and Cheryl Buss (ABSA International).

On the public-sector side, 10 central bank governors and deputy governors and 6 ministers and representatives are expected, including Nadia Fettah (Minister of Economy and Finance, Morocco), Abdellatif Jouahri (Bank Al-Maghrib), Jean-Claude Kassi Brou (BCEAO), Manuel Antonio Tiago Dias (Banco Nacional de Angola), and André Wameso Nkualoloki (Central Bank of the Congo). Around fifteen heads of capital-market and insurance regulatory authorities will also take part in the 45 sessions, including Tarik Senhaji (AMMC) and Hana Tehelku (Ethiopian Capital Market Authority).

For the second consecutive year, Casablanca is hosting AFIS. This choice underscores Morocco’s central role in developing Africa’s financial potential. With a strong regional stock exchange, a solid banking system, and a clear policy of continental integration, the Kingdom embodies the strategic link between innovation, stability, and a Pan-African vision.

Over 1,200 financiers, ministers, central bank governors, and leaders of African institutions are convening to define the conditions for a strong, high-performing African financial sector.

• Discussions will focus on mobilizing domestic and regional capital, modernizing financial markets, and financing the continent’s top priorities: infrastructure, energy, agriculture, industrialization, and digital innovation.

• The 2025 edition positions itself as the pan-African gathering for financial transformation, at a time when international capital is scarcer and African economies must rely more on their own resources to build a sustainable and inclusive future.

About the Africa Financial Summit (AFIS)

Founded by Jeune Afrique Media Group in 2021, with the support of the IFC (World Bank Group), AFIS is a sister organisation to the Africa CEO Forum, the leading platform for Africa’s private sector. AFIS aims to build a robust financial industry that serves the real economy and sustainable development. Bringing together the most influential figures and institutions in African finance, as well as regulators, AFIS works to enhance financial inclusion and foster the emergence of a truly pan-African financial services industry. For more information, visit https://www.afis.africa/fr/afis-2025/annual-summit/.

About the International Finance Corporation (IFC)

IFC – a member of the World Bank Group – is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2025, IFC committed a record $71.7 billion to private companies and financial institutions in developing countries, leveraging private sector solutions and mobilizing private capital to create a world free of poverty on a livable planet. For more information, visit www.ifc.org.