External dependency is not a viable development strategy. Africa financial future lies in mobilising African savings, according to the high-level speakers at AFIS 2025’s opening ceremony.

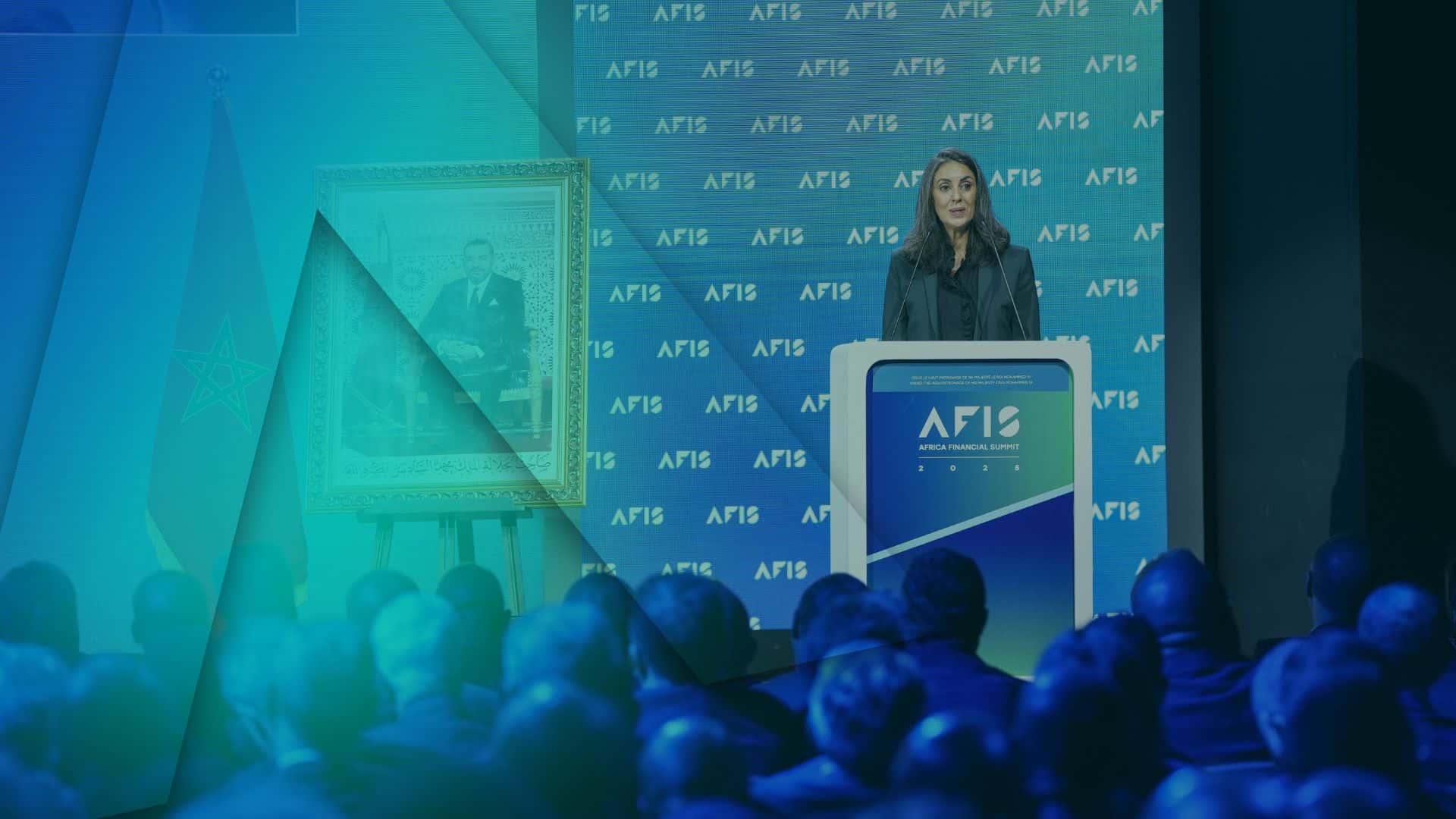

Held under the High Patronage of His Majesty King Mohammed VI, the 2025 Africa Financial Summit (AFIS) in Casablanca on 3 & 4 November brought together over 1,250 leaders and policymakers.

‘Africa does not need to be saved’

Speaking at the Summit’s opening ceremony, Nadia Fettah, Morocco’s Minister of Economy and Finance, rejected narratives of dependency, declaring: “Africa does not need to be saved. It must use its own strengths — transforming its capital into power, and its power into sovereignty.”

She called for a “more united, stronger African financial community,” urging participants “to build a new chapter for a sovereign Africa”.

Amir Ben Yahmed, CEO of Jeune Afrique Media Gorup and Founder of AFIS, echoed this message pointing to “the formidable ambition and vitality” of the continent’s financial sector, where nearly 12 banking groups achieve returns on equity above 20% (vs. an average of around 13% globally, according to McKinsey & Company).

“The capital we need is in our banks, our insurance companies, our pension funds, and our fintechs,” said Ben Yahmed, calling for ambitious regulation to strengthen trust and enhance capital circulation within the continent.

Intra-Africa investments

Makhtar Diop, Managing Director of the International Finance Corporation, warned that African economies face a “magnitude of shocks” from rising debt and declining aid to AI disruption, political uncertainties and commodity volatility. “In my professional career, I’ve never known this level of uncertainty,” he said.

He argued that “the private sector must take the lead,” announcing that the IFC has doubled in recent years its annual commitments in Africa to more than $15 billion, with a growing share dedicated to equity investments and local-currency projects.

Makhtar Diop also called for interoperability among African stock exchanges, noting: “The day a Guinean investor can easily invest in Moroccan assets, and vice versa, we will have achieved something truly transformative.”

Ecobank CEO: Pension funds should back local banks, not just sovereign debt

The Summit’s Opening Panel tackled how to turn Africa’s trillions in untapped domestic assets — in pension funds, sovereign wealth funds, insurance pools, fintech platforms, and bank deposits — into productive, growth-driving capital.

Jeremy Awori, Group CEO of Ecobank Transnational Incorporated, stressed the stark capital gap for African banks compared to Western counterparts: “The top 100 banks together hold $126 billion in capital — less than Citigroup alone ($175 billion), and far below major Chinese banks ($300–500 billion).

“We therefore need pension and sovereign funds to invest in bank equity, not just sovereign paper. That would expand lending capacity to SMEs and the productive.”

He said that Africa faces a “distorted” risk perception driven by rating-agency models that don’t always reflect on-the-ground performance.

“Many Africans prefer to hold wealth abroad due to perceived safety, stability, and yield. If we can build confidence that similar or better returns are possible at home, that capital will stay,” said the Ecobank CEO.

Coronation CEO: ‘Let’s look at the plumbers’

Aigboje Aig-Imoukhuede, Chairman of Coronation Group, added that “the capital is available but it’s not being channelled into the opportunities that exist in Africa”.

He likened the issue to faulty plumbing. “When there’s a problem with the plumbing don’t look at the pipes, let’s look at the plumbers.” The mindset of those “plumbers” — Africa’s public and private financial institutions — must change, he said.

“How many countries in Africa have a well-functioning credit bureau? Less than 10.“

Jules Ngankam, Group CEO of the African Guarantee Fund (AGF)

Aig-Imoukhuede pointed to Japan’s post-war experience: “The domestic capital mobilised for Japan’s reconstruction and transformation was greater than the capital that came from the US government. It required very deliberate action,” he said,calling on AFIS attendees to “de-risk African investments at scale”.

Data gaps, fragmentation and costly compliance: AGF CEO

Jules Ngankam, Group CEO of the African Guarantee Fund (AGF), flagged the severe information gaps facing investors. “How many countries in Africa have a well-functioning credit bureau? Less than 10. So, access to data is really a challenge,” he said.

The AGF chief added that domestic investment remains burdensome for investors, as financial institutions must set aside capital to meet “costly” Basel and IFRS requirements, deal with over 40 separate curriences, and contend with limited secondary markets to transfer risk.

“When you take the regulatory cost that’s coming from all the regulatory regimes across Africa that are fragmented and you take the transaction costs, it’s very costly for investors,” he said.

Ethiopis Tafara, Regional Vice President for Africa at the IFC, said that the industry needs to look closely at its capital markets, where investors including pension funds will go to trade securities.

“Despite the efforts we’ve made, we don’t have enough depth and liquidity in these markets,” he said.

“The most important thing in a market is trust. And that trust comes from having rules in place, but most importantly you have a regulator that is independent and that’s well financed. That’s what we need to spend more time on,” he added.

Tafara stressed that Africa needs to develop a deep pipeline of bankable projects, and that “if we take the time to reach the right equilibrium, we will see real change”.

Across 45+ sessions, explored the building blocks of African sovereignty – from expanding secondary markets for NPLs and repatriating African governments’ FX reserves to forging publicly-listed family businesses with pan-African ambitions.

Photos from the event can be found here.