The proportion of women on financial industry Boards is improving according to the AFIS-Deloitte Barometer – but a major figure from Morocco’s banking sector believes only statutory intervention will lead to meaningful parity.

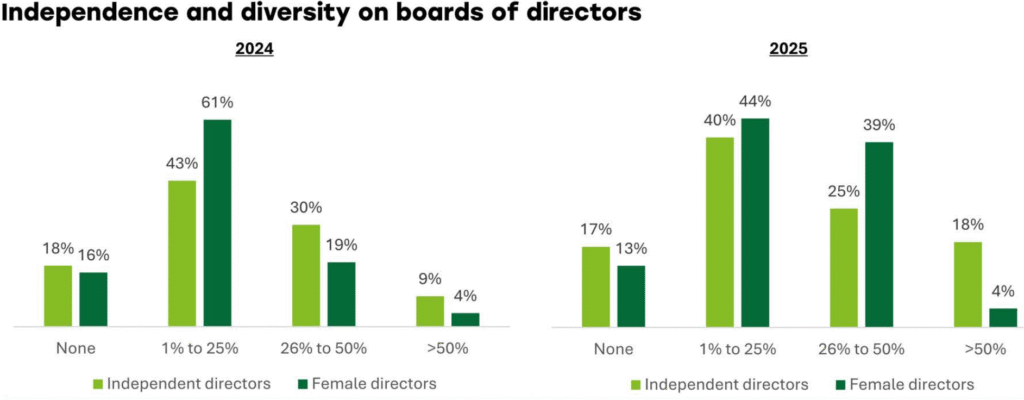

The latest African Financial Industry Barometer – a survey of more than 70 African financial institutions – found that 43% of institutions now have more than a quarter of female directors, compared to 39% of institutions the prior year.

The Barometer authors said the shift was driven by “institutionalization of ESG commitments in appointment policies” following pressure from institutional investors and extra-financial rating agencies.

A growing talent pool with more women in executive positions – such as chief financial officers, chief risk officers, chief legal officers – was also a factor, found the Barometer.

Which sector has the fewest women on Boards?

African capital market players lag significantly behind: 75% of such institutions have no female directors, according to the African Financial Industry Barometer 2025.

Is legislation the only way

Though improving, the majority of African financial institutions (57%) have less than a quarter of female Board members, and 13% have none.

Speaking at AFIS 2025, Samira Khamlichi, President of the Club of Women Directors at CFA Morocco, said her association has been encouraging women’s presence on boards for more than 12 years: “And we realised it was with the law that came out that came out in 2021, that things really began to move.”

Morocco’s Parliament’s introduced a minimum quota of women on Boards of publicly listed companies in 2021, requiring 30% by 1 January 2024 and 40% by 1 January 2027.

In 2011, women occupied 12% of Board seats for Moroccan listed companies. That share is now 29% across the 92 companies listed on the Moroccan market, Khamlichi said at AFIS 2025.

“Since now, quite recently, I am convinced that it can only go through regulation. I think it cannot happen as a soft evolution, because it will not happen,” said Khamlichi, who was the first female CEO of a subsidiary of Moroccan bank Attijariwafa. “Mentalities do not move at the same pace as our societies,” she said.

Hard laws and soft laws

Regulatory stance are taking three forms – hard binding parliamentary legislation that sets minimum quotas for listed companies (rare and limited to Morocco); softer regulatory guidance for banks that encourages targets without imposing legal requirements (Nigeria and Morocco); and as is the case in most African markets no hard or soft guidance.

Central Bank of Nigeria guidelines issued in 2012 encourages commercial banks to have 30% female board members and 40% at top management level. This has coincided with several female Group CEOs for major banks including Fidelity Bank and Zenith Bank.

Bank Al-Maghrib, Morocco’s central bank, also extended the push beyond listed companies in a 2022 recommendation to credit institutions. It urged banks to ensure “satisfactory representation” of women across their workforce and to take proactive steps to increase the share of women in administrative, management and governance roles, and set quantified targets.

EU's stance

Africa’s largest trading partner, the EU, issued a directive applicable from 2025 requiring at least 40% of non-executive board seats be held by the underrepresented sex. The share of women on corporate boards averages 34% in the EU.

“Billions of dollars of value on the table”

Souad EL HAMDI, a Partner at Forvis Mazars, said women’s underrepresentation was bad business: “Africa leaves billions of dollars of value on the table every year,” she said at AFIS 2025. “Companies with diversified boards of directors—and no one can say the contrary—these companies display better financial performance, higher ESG scores, strengthened profitability, and strong innovation.”

Credit Suisse analysis of 2,400 publicly trade companies globally found that women on company Boards correlates to higher average return on equity, better growth and higher valuations.

Similarly, research of 55 insurance companies in Kenya found gender diversity on Boards “significantly and positively” affects the financial performance of insurance firms.

According to Khamlichi, the gender gap widens at two critical moments for women: as they leave education to join the workforce, and during maternity when men are perceived to be focused on their careers.

“If we don’t have the ability to regulate at these two critical moments, we won’t succeed,” she said. “And I bet you anything you like that in 10 years’ time, we’ll be having the same discussion at this table,” she said at AFIS 2025 Workshop titled “Addressing governance blind spots in pay parity, progression and retention”.

She added that in countries with legislation or guidelines, the rules are often not applied and are mere “tick boxes to seem politically correct”.

“It is our role to lobby so that these laws, God willing, apply,” she said.