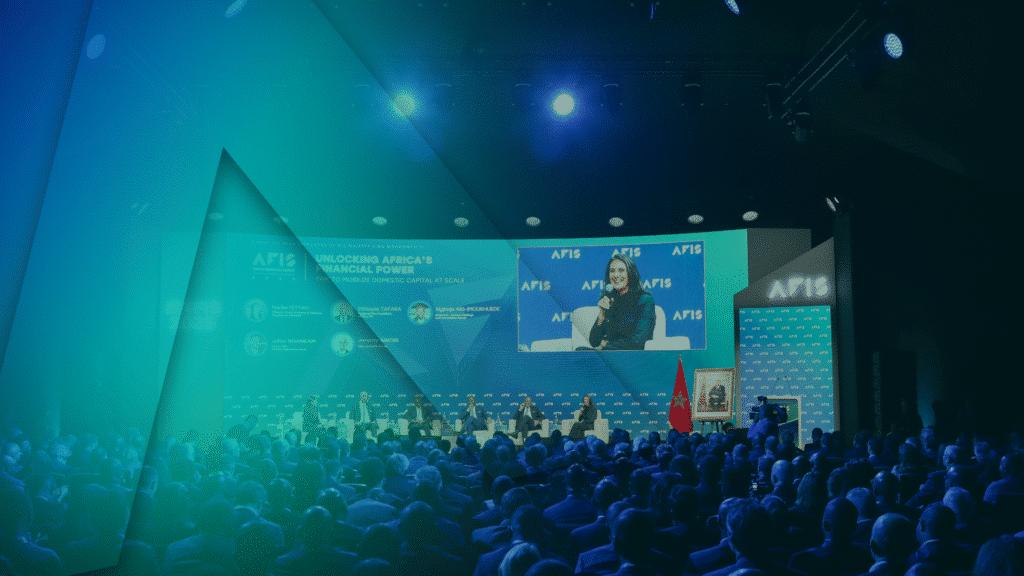

Casablanca, 5 November 2025 – The fifth edition of the Africa Financial Summit (AFIS) concluded yesterday evening in Casablanca, following two days of high-level exchanges and debates that brought together more than 1,250 financial decision-makers, ministers, central bank governors, heads of regional institutions, and private sector leaders from across the continent and beyond.

Held under the theme “Unlocking Africa’s Financial Power: Time to Mobilise Domestic Capital at Scale,” this year’s edition demonstrated that the key to developing a robust and high-performing African financial sector lies less in aid or external capital and more in mobilizing Africa’s own resources. Against the backdrop of tightening global monetary conditions and dwindling international capital flows, participants reaffirmed a shared conviction: Africa must now rely on its domestic resources to build a strong, inclusive, and investment-oriented financial system.

Over two days, more than thirty conferences, workshops, and roundtables brought together bankers, insurers, fintech innovators, institutional investors, policymakers, and regulators to explore ways to channel African savings toward the key sectors driving the continent’s transformation: infrastructure, energy, agriculture, industry, and digital innovation.

AFIS 2025 also served as a laboratory for concrete solutions, with partnerships announced during the event. Among them: a new agreement between Proparco and the European Union establishing an Impact Guarantee Facility (€178 million) and a Technical Assistance program (€7.8 million) to support sustainable investments and high-impact enterprises across Africa; as well as an agreement between Ecobank Group and Proparco to facilitate Ecobank Chad’s integration into the Trade Finance program. IFC also announced investments totaling $310 million in projects that will support the growth of smaller businesses and job creation across several African countries, including a $250 million risk-sharing facility with Saham Bank and a $50 million financing package to Suez Canal Bank.

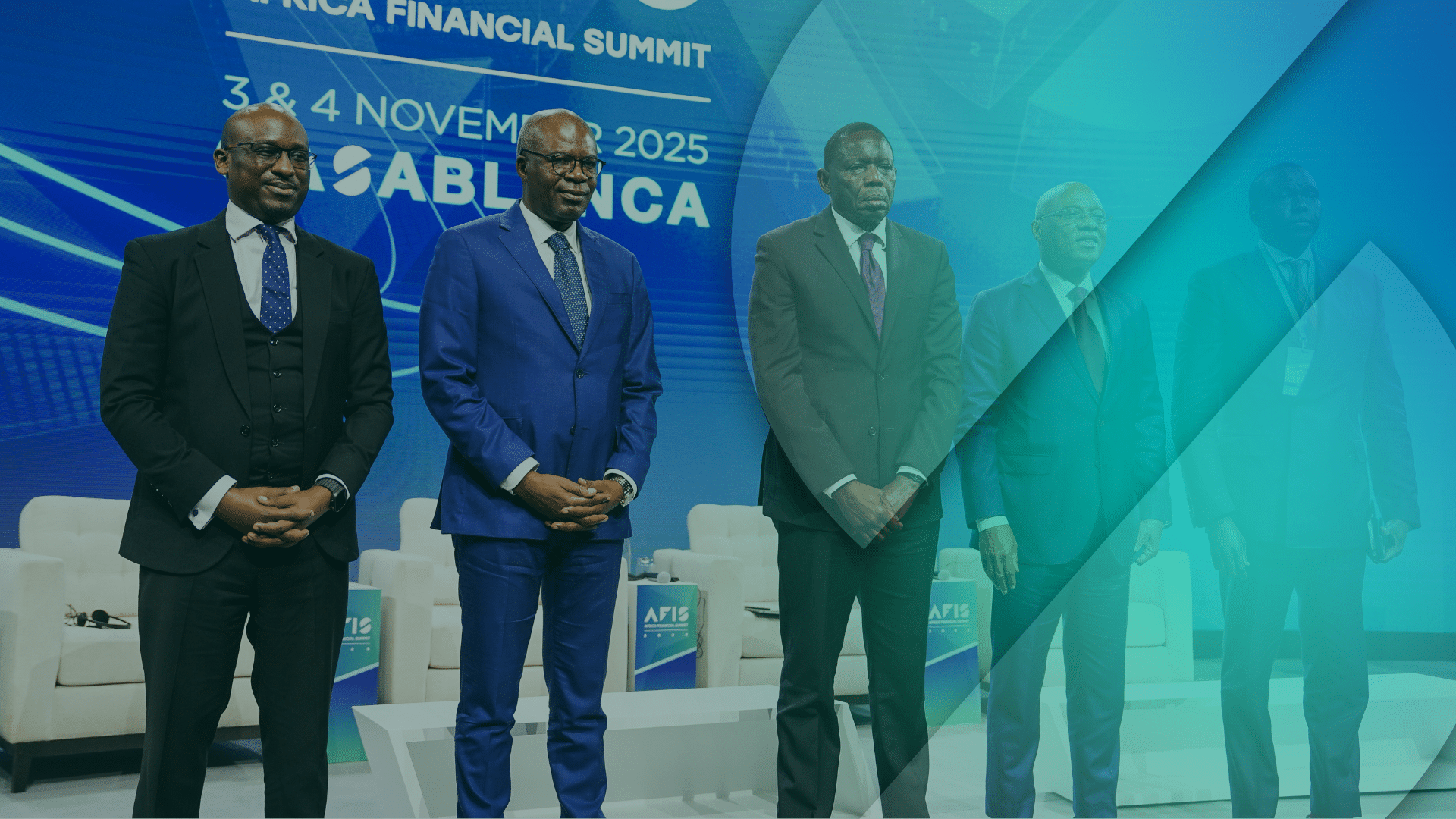

The closing panel brought together four central bank governors, offering a powerful illustration of the continent’s financial ambitions:

Jean-Claude Kassi Brou, Governor, BCEAO, stated: “Banks, for their part, must do more to mobilize resources. We will review regulations, if necessary, but the first move must come from the banks themselves. Too often they rely on deposits from governments and large corporations. They must be more imaginative – especially in tapping long-term resources such as insurance funds, pension funds, and diaspora bonds.”

Manuel Antonio Tiago Dias, Governor, Banco Nacional de Angola, stated: “We know that digitalisation will be central to expanding financial inclusion. The central bank itself is looking to integrate AI into its work: in supervision, reporting, and risk analysis. Commercial banks will not wait for us to act first, so we must evolve together.”

André Wameso, Governor, Central Bank of the Congo, stated: “We must embrace the world as it is – one driven by digitalization. In countries like ours, industrial infrastructure is scarce, but new technologies can help us leapfrog traditional development paths. Thanks to systems like Starlink, we no longer need to wait two or three centuries to build fiber-optic networks.”

Michael Atingi-Ego, Governor, Bank of Uganda, stated: “Governments are increasingly crowding out the private sector in credit markets. We must be innovative. One path forward is to institutionalize ESG principles within our financial systems. By embedding environmental, social, and governance criteria, we can encourage banks to channel more credit into agriculture and to support local content.”

At the closing event, Aliou Maiga, IFC’s Financial Institutions Group (FIG) director for Africa, said: “Africa’s financial sector is undergoing a profound transformation-driven by stronger institutions, expanded access to finance, and a growing commitment to inclusive growth. As highlighted during this edition of AFIS, building strong domestic and regional financial systems is not just essential – it’s foundational to unlocking Africa’s full potential. By strengthening these sectors, we pave the way for the continent to lead in financing jobs and sustainable development.”

By hosting AFIS for the second consecutive year, Morocco reaffirmed its strategic role in building an integrated African financial hub – combining stability, innovation, and continental openness. The conversations initiated in Casablanca will continue next May in Kigali, at the Africa CEO Forum, which will once again bring together the continent’s leading economic decision-makers.

About the Africa Financial Summit (AFIS)

Founded by Jeune Afrique Media Group in 2021, with the support of the IFC (World Bank Group), AFIS is a sister organisation to the Africa CEO Forum, the leading platform for Africa’s private sector. AFIS aims to build a robust financial industry that serves the real economy and sustainable development. Bringing together the most influential figures and institutions in African finance, as well as regulators, AFIS works to enhance financial inclusion and foster the emergence of a truly pan-African financial services industry. For more information, visit https://www.afis.africa/fr/afis-2025/annual-summit/.

About the International Finance Corporation (IFC)

IFC – a member of the World Bank Group – is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2025, IFC committed a record $71.7 billion to private companies and financial institutions in developing countries, leveraging private sector solutions and mobilizing private capital to create a world free of poverty on a livable planet. For more information, visit www.ifc.org.